2021 Deloitte Art & Finance Report

How has the state of the art changed with the pandemic? Let’s find out in the new report just published by Deloitte Private.

Uncertainty and flexibility were the two constants of an art market that in 2020 necessarily increased its propensity for innovation and experimentation in order to survive.

This is what emerged from the webinar dedicated to the topic of Art & Finance: The art and collectible goods market | Report 2021 – Special “The state of the art at the time of Covid-19” presented yesterday by Deloitte Private.

The report is dedicated to the impacts of the pandemic on the artistic and cultural sector through a survey conducted among operators, collectors, scholars and enthusiasts of the sector.

The evidence that emerged was compared with data from the first edition of the research published in June 2020, with the aim of identifying solutions to address the current crisis.

“The market is fragile and vulnerable”: this is how Pietro Ripa, Fideuram’s Private Banker opens the webinar, which highlights the main trends of the 2020 auctions for works of art and collectibles

While a 60% decline was recorded in the first half of the year, at the end of 2020 this settled at 29% thanks to a series of strategies implemented by auction houses such as:

- The “cross-category” catalog, therefore including works of art and collectibles belonging to different historical periods or departments.

- A new bidding format, more precisely “the hybrid auction” – on 6 October 2020 Christie’s sells a T-Rex at the 20th Century Evening Sale in New York for $ 31.8 million dollars.

- New strategic collaborations with players in the Asian market (which currently drives the global market).

Il processo di digitalizzazione del mondo dell’arte ha senza dubbio accelerato un trend di continua crescita nel mercato dell’arte online che secondo l’Art Basel e UBS Global Art Market Report, si attestano al 25% del totale.

The digitalization process of the art world has undoubtedly accelerated a trend of continuous growth in the online art market which, according to Art Basel and UBS Global Art Market Report, amount to 25% of the total.

Limiting itself to the auction market only, online has proved effective above all for the sale of low-medium value lots, while it is still limiting in the sale of medium-high value and top quality lots: if in 2019 the record sales are were recorded by Claude Monet at $ 110.7 million and by Jeff Koons at $ 91.1 million, in 2020 the records go to Francis Bacon at $ 84.6 million and Roy Lichtenstein at $ 46.2 million.

In general, 44% of the art players recorded a reduction in turnover between 25-50% and this also due to the lack of participation in art fairs which, despite their digital version, had results in chiaroscuro due to of little user friendly platforms that have made the virtual experience uninvolving and effective.

All this before Crypto Art represented the new era, following the sale of Beeple’s work at Christie’s. In this regard, Mariolina Bassetti, Chairman of Post-War & Contemporary Art, Continental Europe and Chairman of Christie’s Italia intervenes, who argues that “the Crypto Art NFT market represents our present and the future, so it is necessary to observe the phenomenon with interest”.

Roberta Ghilardi, Deloitte Private Sustainability Senior Consultant, presented some interesting outlooks for the future. Among the most significant we find:

- Internationalization and new buyers: the number of Millennial collectors who have purchased collectible goods is growing, especially in “online-only” auctions. Christie’s announced that 32% of the new buyers of “online-only” sales were millennials (23-38 years old), while Sotheby’s has seen the number of buyers under 40 double.

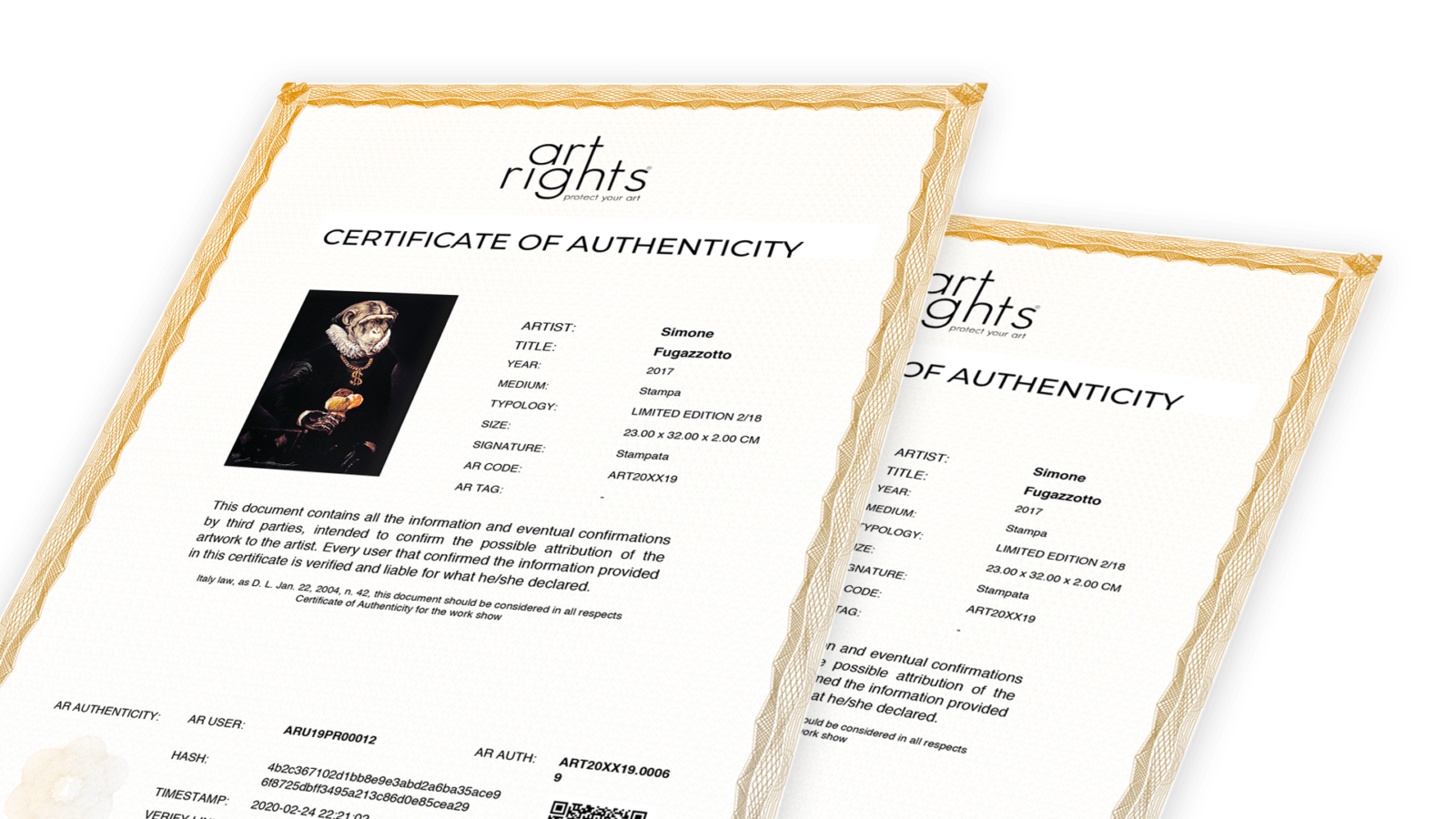

- Digitization and transparency: one of the positive consequences of the digitization process was the increase in price transparency which resulted in greater confidence in the possibility of online purchases (83%).

- Growth of Private Sales: the desire for confidentiality and speed in transactions has increased the turnover generated by private sales: Sotheby’s, in particular, recorded a record result for private sales, which went from $ 1.0 billion in 2019 to $ 1, 5 billion in 2020.

Finally, during the round table mediated by Barbara Tagliaferri, Art & Finance coordinator for Italy and composed by Tommaso Calabro (founder of Galleria Tommaso Calabro), Ugo Nespolo (artist), Verusca Piazzesi (director of Galleria Continua), Simone Menegoi (Director of Arte Fiera) and Francesca Rossi (Director of the Civic Museums of Verona) it emerged that the world of art, now more than ever, needs networking, that is to say “networking”.

And this not only between individual institutions and professionals, between which a relationship of cooperation and mutual support must be established, but also between the physical and the digital which, in a few months, has revolutionized the methods of use, purchase and offer. of art, most recently through the introduction of NFT – Non Fungible Token.

And you, are you ready to discover the future of the art market?

Photo Credits: Liu Bolin for Deloitte Private