The Art Funds: what they are, advantages and disadvantages

For several years now, the art market has been considered a good investment and an art fund is a great opportunity for a collector. Let’s find out how and why.

As the latest report compiled by Deloitte shows, 8 out of 10 collectors say they buy art for passion but also for investment.

For this reason, investing in Art Funds represents a strongly growing trend, as well as an excellent opportunity to sell and buy works in total safety.

What are art funds?

Art funds are closed-end funds, private or hedge, which are usually managed by an asset management company and are structured forms of investment in works and objects of art.

There are two types of art fund investments out there:

- long term (8-10 years), with investments in works covering the entire period of art history.

- short term (5 years), with investments related to contemporary art only.

How to invest in an Art Fund?

The investor must purchase the fund’s shares with a minimum entry threshold. During the period of the investment, the fund managers create a collection, relying on the expertise of experts in the field, and a project to enhance the value of the works is initiated.

Once this period is over, the works are resold and the proceeds, after deducting the costs of managing and administering the fund, are divided among the investors.

What are the main benefits?

- The investment is less risky and onerous than that of individual works of art.

- There are lower costs of managing and preserving the works.

- The medium to long time frames required by the investment allow the manager to determine the best time to sell while maximizing profits.

What are the critical issues?

- The opacity of the art market prevents transparent and certain evaluations.

- The specificity of the market requires increasingly specific professionals and skills.

The creation of an art fund in fact requires methodologies, procedures and professionalism capable of enhancing, promoting and finally selling the works of art.

First of all, the identification of the provenance, state of preservation and authenticity of the works.

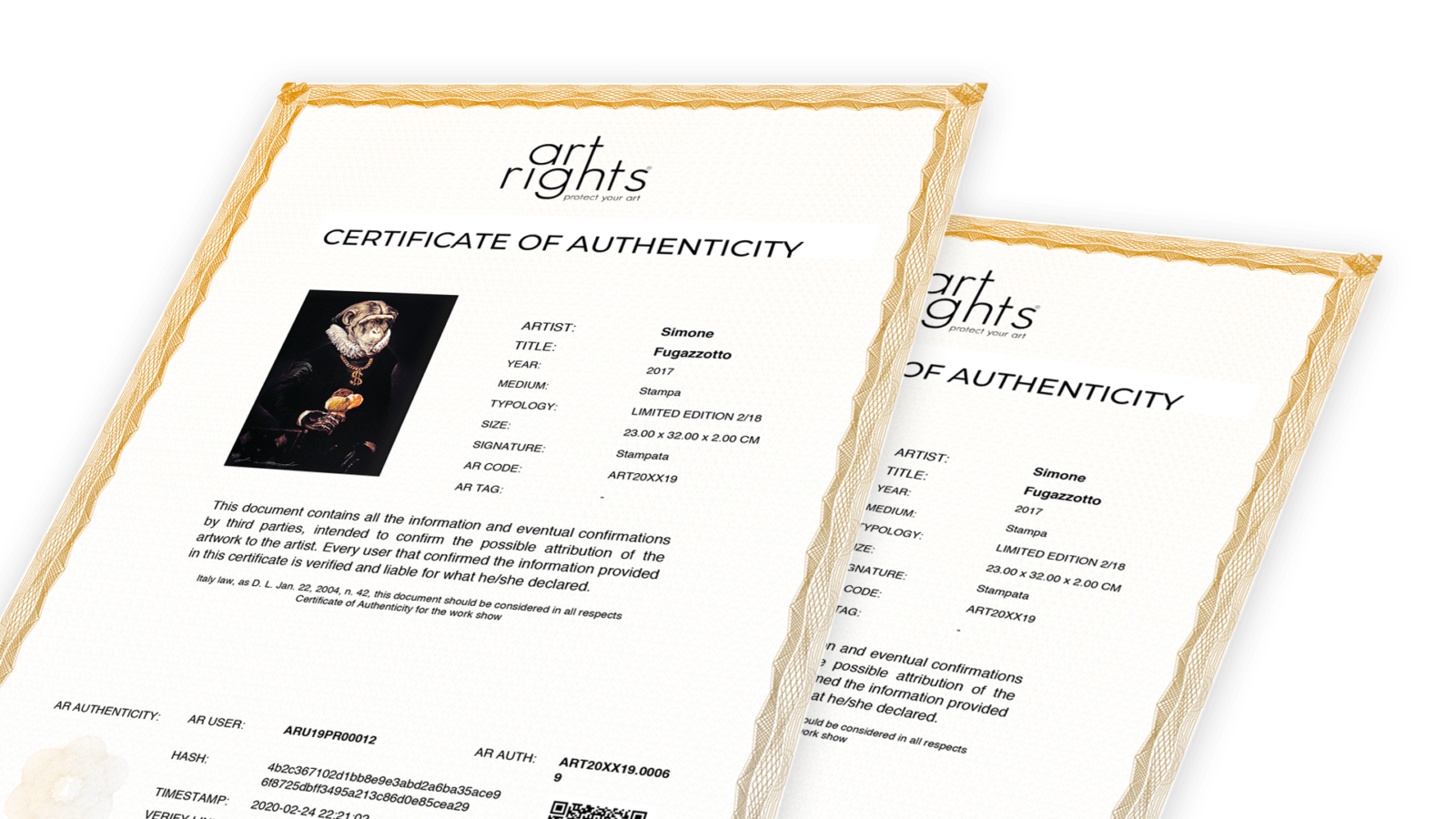

To support these operations there is Art Rights, a platform for the management and certification of information on works of art with Blockchain technology and Artificial Intelligence, which offers the possibility, through the service of Art Concierge, to get in touch with the largest community of art professionals.

How about you, are you ready to invest in an Art Fund?

Photo Credits: Carl Court / Getty Images