ART WEALTH MANAGEMENT: ARTE AS INVESTMENT

Today art is a “passion asset”, increasingly linked to asset management.

Nowadays it is normal to talk about the art collection as part of a collector’s heritage, but it has not always been the case.

In fact, the awareness that Art can also be considered an asset part of one’s heritage has become a reality in recent years, as recorded by the numerous Art&Finance reports by Deloitte, when requests for advice on the management and enhancement of collectibles began to reach professionals such as wealth managers, family officers and private banker.

These services include tailored asset management, through financial consulting, accounting services, legal and tax planning included in Wealth Management.

But what is Art’s relationship with Wealth Management?

The so-called Art Wealth Manager today is worth 2 billion dollars, and it’s constantly growing!

So why has the world of Wealth Management long been reluctant to include art in asset management?

The reason for this is explained in the last report that Deloitte conducted with ArtTactic.

Among the main concerns expressed by Wealth Management are the lack of transparency in the art market, the still fragmented regulation, the lack of expertise and not least the lack of support from the leading realities of the sector.

Despite the initial difficulties and prejudices, the situation today has definitely improved: collectors’ needs have finally been met and the constant increase in attention to specific services dedicated to art represents a consolidated trend.

Again according to the Deloitte report, 86% of the asset managers surveyed stated that they included the management of artistic and collectors’ items in the services offered in response to the desire expressed by collectors themselves (81%) both to be guided in this direction and to have consolidated reports.

Today we are witnessing not only the revaluation of art as an asset but also a real change of perspective on the part of wealth managers: wealth managers want to extend their consultancy offer with additional services such as art appraisal, l’art advisory, collection management, advice on regulatory and inheritance aspects. All this as a consequence of the affirmation of a “client-centric” vision that foresees the planning of services to consolidate and strengthen the relationship with collectors.

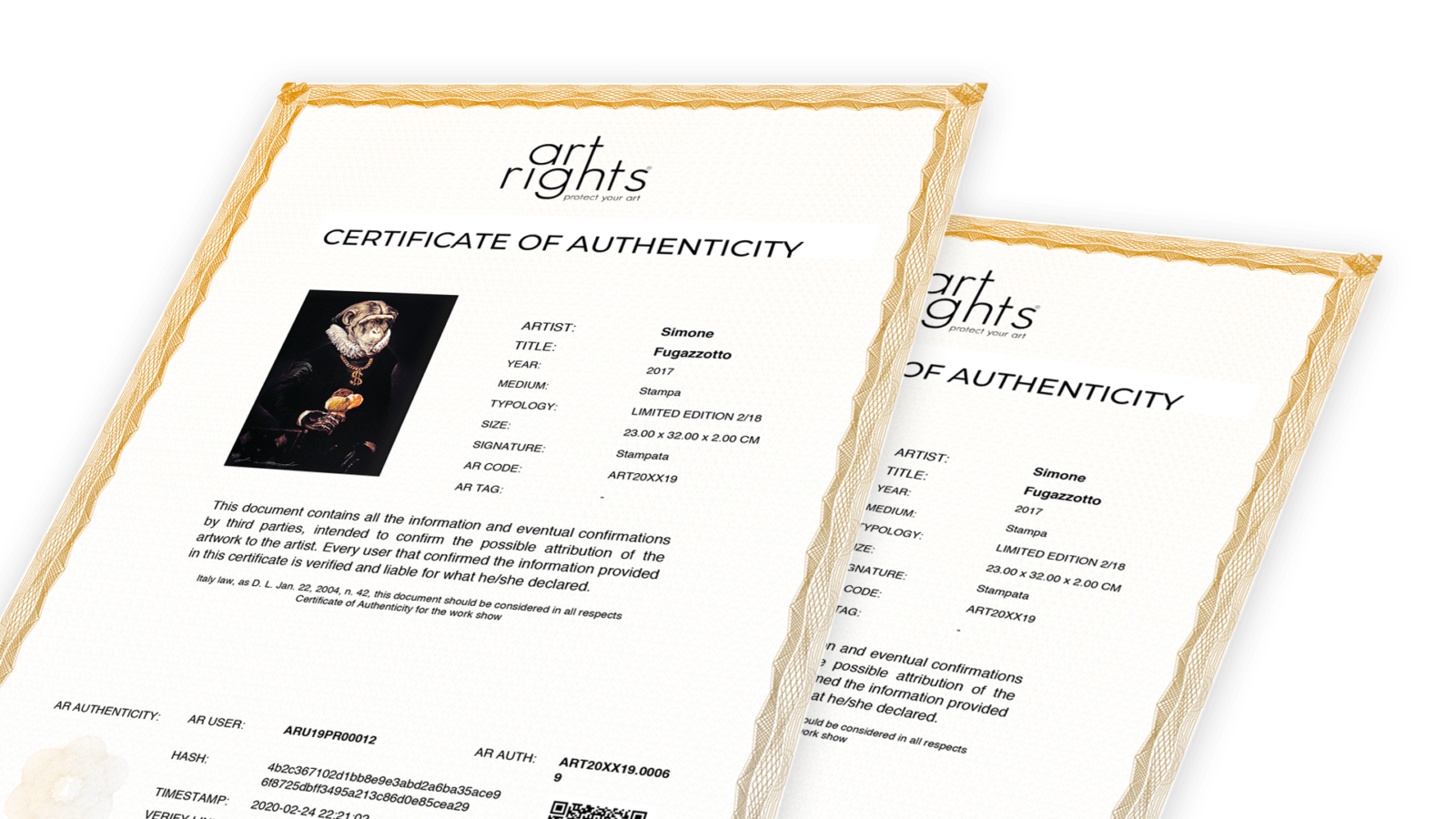

Finally, it should be emphasized how careful digital cataloguing is fundamental in the definition of planning strategies, as it ensures that the collection is ordered and updated with all the documentation related to the history, evaluations, transfers of ownership, handling, lending, conservation status and insurance of the works.

If we look at the needs of collectors regarding the services required for asset management, it is clear how the worlds of art and finance are influencing each other, bringing in both dynamic areas and demands for totally new skills compared to the past, which therefore involve new job opportunities and growth.