It’s Brexit Time: the challenges of the art world between costs and documentation

By Laura Viviani

Laura Viviani, Fine Art Logistic Expert, presents in detail what are the changes and rules that the art market now follows from the entry into force of Brexit, including costs, timing and documentation of the works that can never be missing.

It is a fact that for over four months now the movement of works of art to and from the United Kingdom has become complex for collectors as well as for operators.

To send or receive works of art from the United Kingdom it is now necessary to carry out customs checks just like for any territory that is not part of the European Union.

To analyze the main characteristics and the challenges that the operators of the art world are facing, it is necessary to distinguish between imports and exports, and again between temporary or definitive.

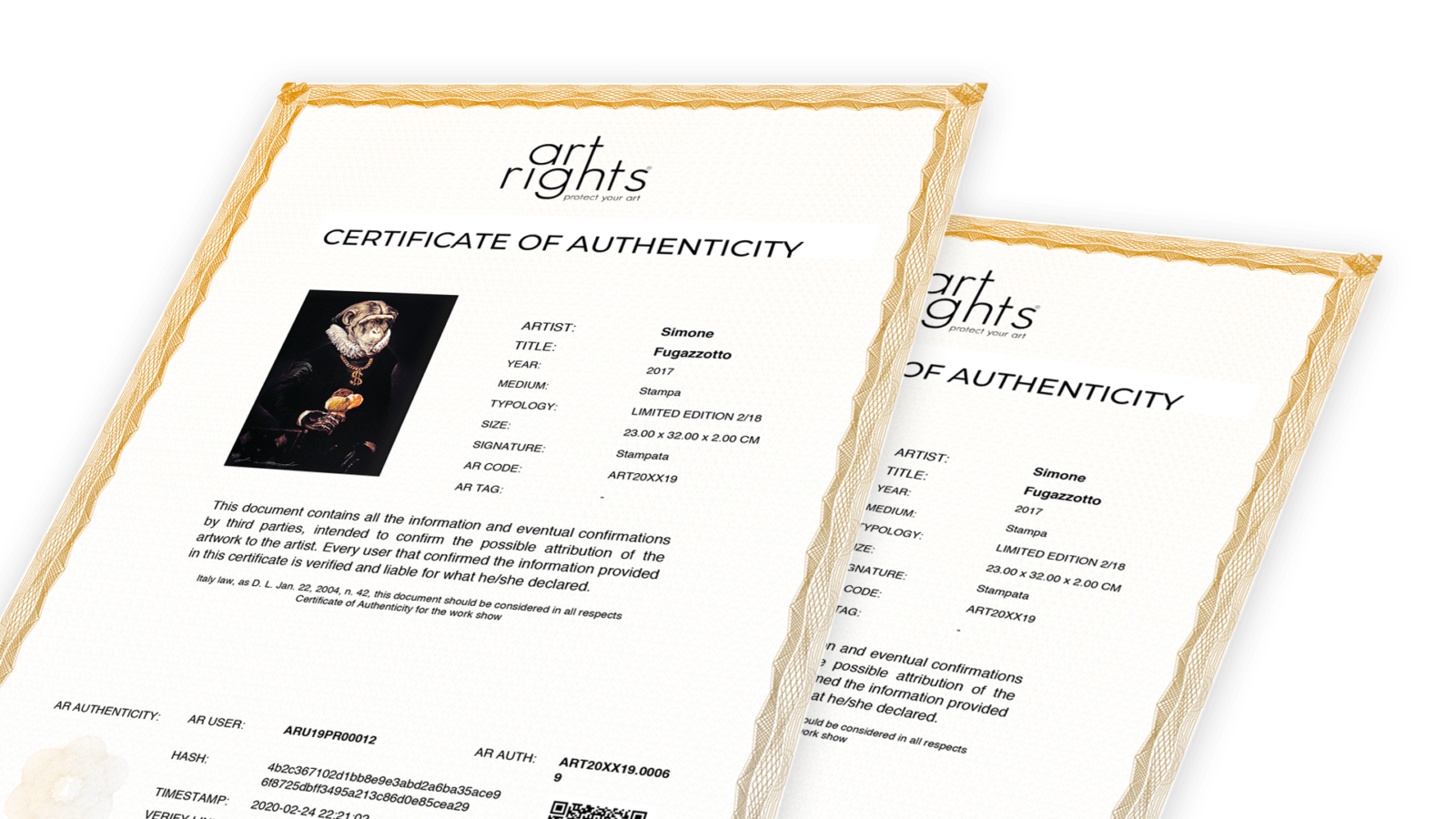

In definitive importation, the importer is subject to the payment of customs VAT of 10% on the value of the invoice presented for the operation (+ the freight fee). Among the documents necessary for importation, the CMR (international transport document), the invoice, the photograph of the work that we import finally a declaration that it is actually a work of art thus avoiding the object being submitted at a tax rate of 22%.

In the definitive export, the exporter is not subject to the payment of customs taxes, but it is necessary to complete the customs export formalities, formalities that require the presentation of the fine arts clearance, whatever age or value the exported works have, as well as than a valid export invoice.

But what happens to a work sent to the UK for attempted sale or exhibition before Brexit comes into effect and which now must return because it was unsold or due to the end of exposure?

Is the importer subject to the payment of customs taxes on the value? The answer is NO, but….

Here is that to remedy the payment of 10%, the customs asks for proof that what is declared corresponds to the truth.

For the collector or the professional, it becomes very essential to be in possession of all the documentation used for the pre-Brexit export, namely: transport CMR, Fine Arts authorization, a formal document with which the English requesting body requested the work by attempted sale or exhibition.

However, customs will also request a declaration from the owner confirming the reasons justifying the temporary export and a declaration of “unsold” or “deadline” by the English requesting body.

In any case, both for import and export, the customs always reserves the right to see the work before authorizing the exit.

So what are the changes being made to art with the entry into force of Brexit?

COSTS

In fact, the cost of the customs procedure must now necessarily be added to the cost of transport, which varies at the discretion of the operators present on the market.

THE TIMINGS

It takes about 2 working days to get the clearance for a definitive one, a few more days for the temporary one.

However, the new rules have not discouraged the market. In reality, exports to the United Kingdom have not suffered from the crisis due to Covid and the results are still encouraging.